Even though gas prices in California continue to be the highest in the country, some residents could soon see financial respite. The budget for 2022–2023 that Governor Gavin Newsom signed in June contains direct payments ranging from $350 to $1,050 for 23 million Californians, or more than half of the state’s prostates.

According to the California Franchise Tax Board, payments will begin to be distributed on October 7. A calculator for calculating your payout amount is available on the state’s “Mstate’sl” ss Tax Refund” informal” page.

When And How Will Payments Be Issued?

California California’s Tax Board (FTB) will distribute stimulus monies via debit cards and direct deposits. You would get your Middle-Class Tax Refund by direct deposit between October 7 and October 25 if you received either of the two prior Golden State Stimulus payments by that method. You may also read another trending article, ‘Rainbow F’ntany’ Has Been’Discovered In Oregon And Idaho, But Not In Washington!

Otherwise, you can anticipate receiving a direct transfer between October 28 and November 14 if you electronically submitted your 2020 California tax return and received a refund by direct deposit. The balance will be distributed via debit cards.

You should anticipate receiving a debit card for the Middle-Class Tax Refund between October 25 and December 10 if you paid for the Golden State Stimulus with a debit card. By January 15, 2023, all other debit card payments will have been made.

90% of payments, according to the Franchise Tax Board, should be made in October. Early October will announce a complete payment schedule for debit card holders, and the FTB informed Forbes Advisor.

Middle-Class Tax Refund Eligibility

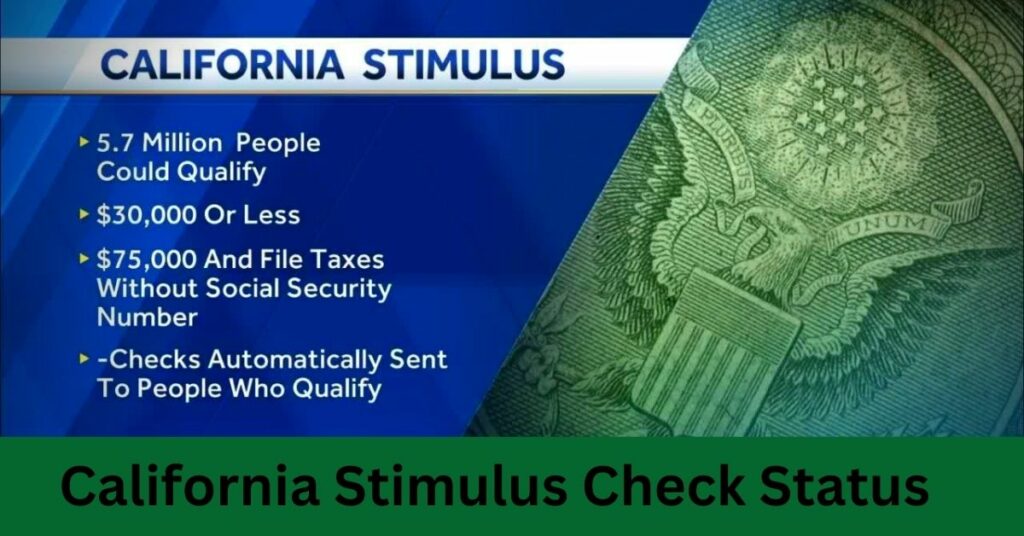

The Middle-Class Tax Refund is anticipated to be available to 23 million citizens. You must have lived in California for at least six months in 2020 to be eligible, and your 2020 state tax return must have been submitted by October 15, 2021.

You must be a resident of California on the date your payment is made and cannot be claimed as a dependent on anybody else’s return for the 2020 tax year. Based on income and tax-filing status, the payments will be made on a sliding basis.

Taxpayers with low incomes with at least one dependant benefit most from this measure. People who make more than $75,000 will not receive the full benefit, as they did with the first two Golden State Stimulus payments, but other information has changed.

The eligibility for the maximum award is broken down as follows:

- $350: People with annual incomes under $75,000.

- Couples filing jointly and making less than $150,000 annually pay $700.

- An additional $350 is due to the families listed above with at least one dependant.

Income requirements to receive the minimum payout:

- $200: People with annual incomes up to $250,000.

- Couples filing jointly with less than $500,000 annually will pay $400.

- An additional $200 will be paid for the households above with at least one dependant.

What Else Is in the Inflation Relief Package?

Along with stimulus payments, the $17 billion inflation-relief package included in the bigger state budget also assists with rent and electricity prices and a temporary suspension of state diesel taxes.

Diesel Tax Holiday

The suspension of California’s 68 cents per gallon gas tax, the highest in the country, is not part of the state’s financial plan. On the other hand, the budget will contain a 12-month suspension of the state sales tax on diesel fuel beginning on October 1.

Other Benefits for California Residents

A few other initiatives are included in the budget to lessen how much citizens will be affected by inflation:

- For eligible low-income tenants who requested help by March 31 and received $1.95 billion,

- Residents will receive $1.4 billion in funding to assist with unpaid utility bills.

A $14.8 billion infrastructure and transportation program is also included in the budget, along with an additional $200 million for services related to reproductive health.

The new California budget also grants low-income citizens between the ages of 26 and 49 access to universal health coverage, making it the first state to do so.

Final Lines

Share your thought about this in the comment section below. Read other trending articles like Washington, And Oregon Voters Say Abortion only on the website domaintrip.com.

Contents